Pay As You Earn (PAYE)

Advice NI

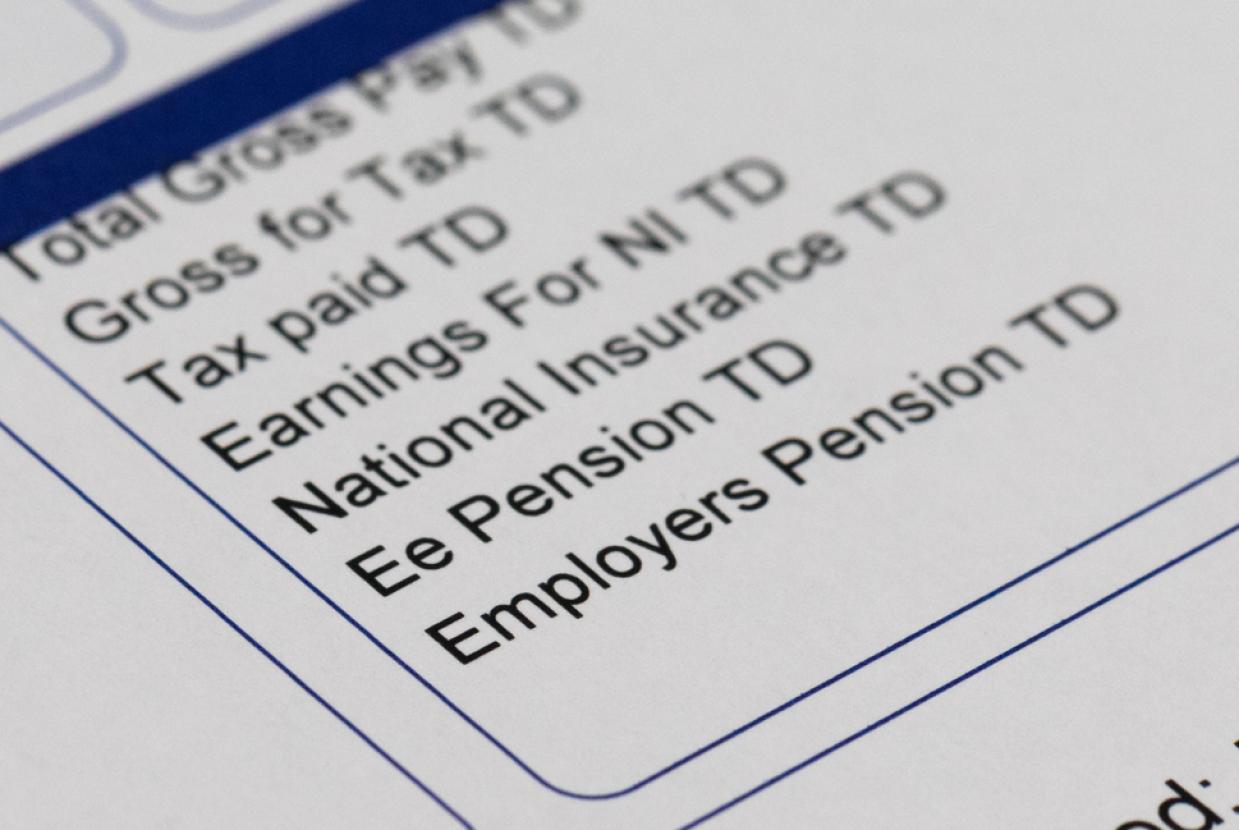

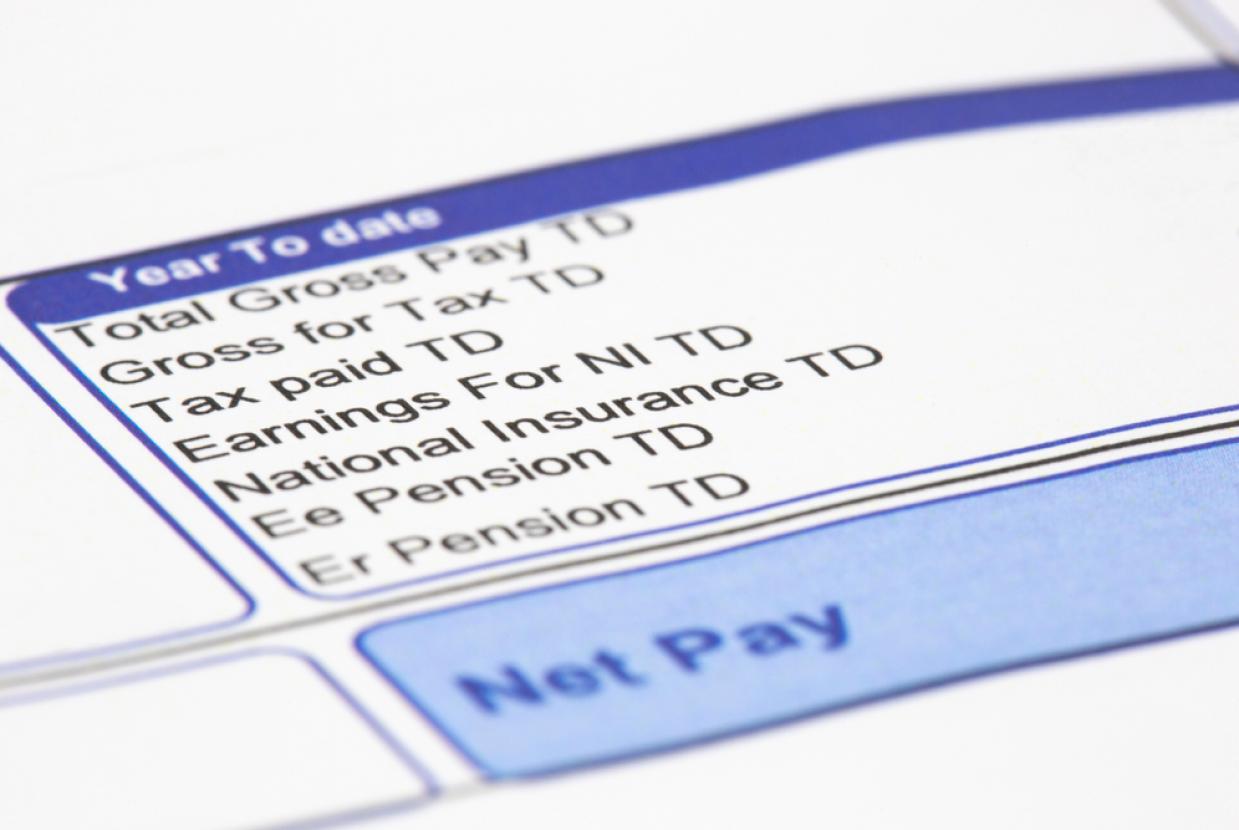

PAYE (Pay as you earn) is an income tax that is deducted from your earnings. The money is sent to HMRC from your employer.

This is the most common method of paying income tax if you are employed. If you are self-employed, you pay income tax through self-assessment.

PAYE is calculated based on how much money you earn and if you are eligible for the personal allowance. Your personal allowance is the amount of money you can earn in a tax year before you need to pay income tax.

The standard Personal Allowance for 2021 - 2022 is £12,570.

More information on PAYE can be found on gov.uk: