Protect Yourself From Illegal 'Finfluencers'

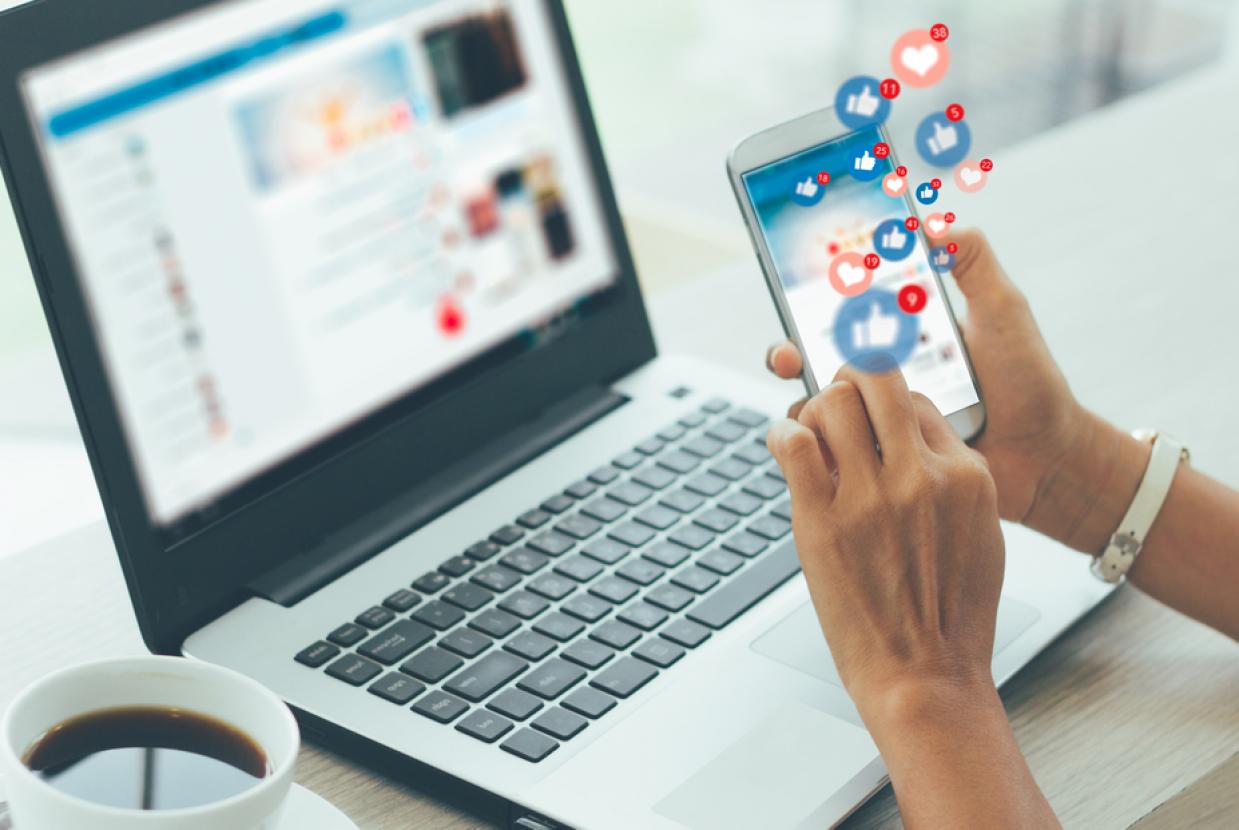

Cyber Security / Managing Your MoneyIf you’ve spent any time scrolling on social media, odds are you’ll have come across a growing number of financial influencers – ‘finfluencers’ – who are sharing tips online on how to spend, save and invest. There are all types, from budget-savvy mums telling you how to save at the supermarket, to finance-bros saying you can get rich quick. But here’s why you should be wary of some finfluencers.

What are finfluencers?

Finfluencers are social media personalities, typically on TikTok and Instagram, who share ‘insights’ about money with their followers. They’re increasingly popular, with 36% of adults using social media to get financial information and advice.

Lots of these creators are great at what they do, offering a mix of entertainment, showing you their day-to-day life, all while explaining concepts and offering tips on personal finance. But there’s a growing number who are acting illegally – promoting financial products without being authorised to do so. Some are doing this to deliberately scam you – others because they’re unaware of the rules. But both types are doing something illegal.

If you follow high-risk tips – you could lose your money

If you put your hard-earned cash in high-risk investments or scams promoted by illegal finfluencers you are putting your money at serious risk. The influencers may look professional and convincing, but following their advice could mean you lose some – or even all – of your money. You may even have followed a creator for a while and like them, but if they give financial advice and are not qualified to do so, it’s still illegal and you may find you get scammed.

So the regulator, the Financial Conduct Authority (FCA) is cracking down on these illegal finfluencers. A group of high-profile reality stars are currently awaiting trial and facing potential jail time for promoting illegal investment schemes to their Instagram followers.

The good news is you can protect yourself from this type of financial crime.

Spot the warning signs

The only people who are allowed to give regulated financial advice are qualified financial advisers who are authorised to do so and regulated by the FCA. A regulated adviser must take your full financial circumstances into account and act in your best interests when helping you make a financial decision. Importantly, you can make a formal complaint if you believe you were mis-sold advice.

Illegal finfluencers won’t be FCA-regulated or authorised – an easy way to tell is regulated advisers will appear on the FCA Firm Checker or the Financial Services Register. A legitimate financial adviser will also be clear and upfront about their qualifications and tell you they’re regulated so if the influencer isn’t transparent, be careful.

Other red flags – illegal influencers may:

- promise guaranteed or very high returns in a short period of time

- have a sense of urgency – you need to ‘act now before you miss out’

- promote little-known or ‘exclusive’ investment opportunities

- not clearly disclose when they are making money out of paid for or sponsored content (financial promotions on social media have to follow very strict rules)

- suggest complex financial strategies (such as cryptocurrencies) without explaining the risks.

But it’s not just crypto finfluencers promote – some scams involve more traditional fake ‘investment opportunities’.

Protect yourself

Before you risk your money with unregulated advice, there are trusted sources to help. To stay safe from illegal finfluencers:

- look at the FCA Firm Checker and the Financial Services Register to see if a person or firm is authorised to give advice

- check the FCA Warning List before investing

- visit the FCA’s InvestSmart site to learn more about investments and risk, and use tools like this checklist.

Get trusted, impartial financial guidance

Remember, promises of guaranteed or very high returns are usually too good to be true. If you’re going to invest, you’re taking a risk – and anyone claiming otherwise isn’t being honest.

So rather than relying on unverified social media advice, use MoneyHelper for free, impartial guidance that's backed by government. We’re here to help with the steps you can take to invest with confidence so you are empowered to make informed decisions.

While we offer guidance, when making important financial decisions you can get professional advice that the FCA regulates to protect you. You can find an FCA-approved financial adviser with MoneyHelper's guidance on Financial advice.