Debt & Mental Health

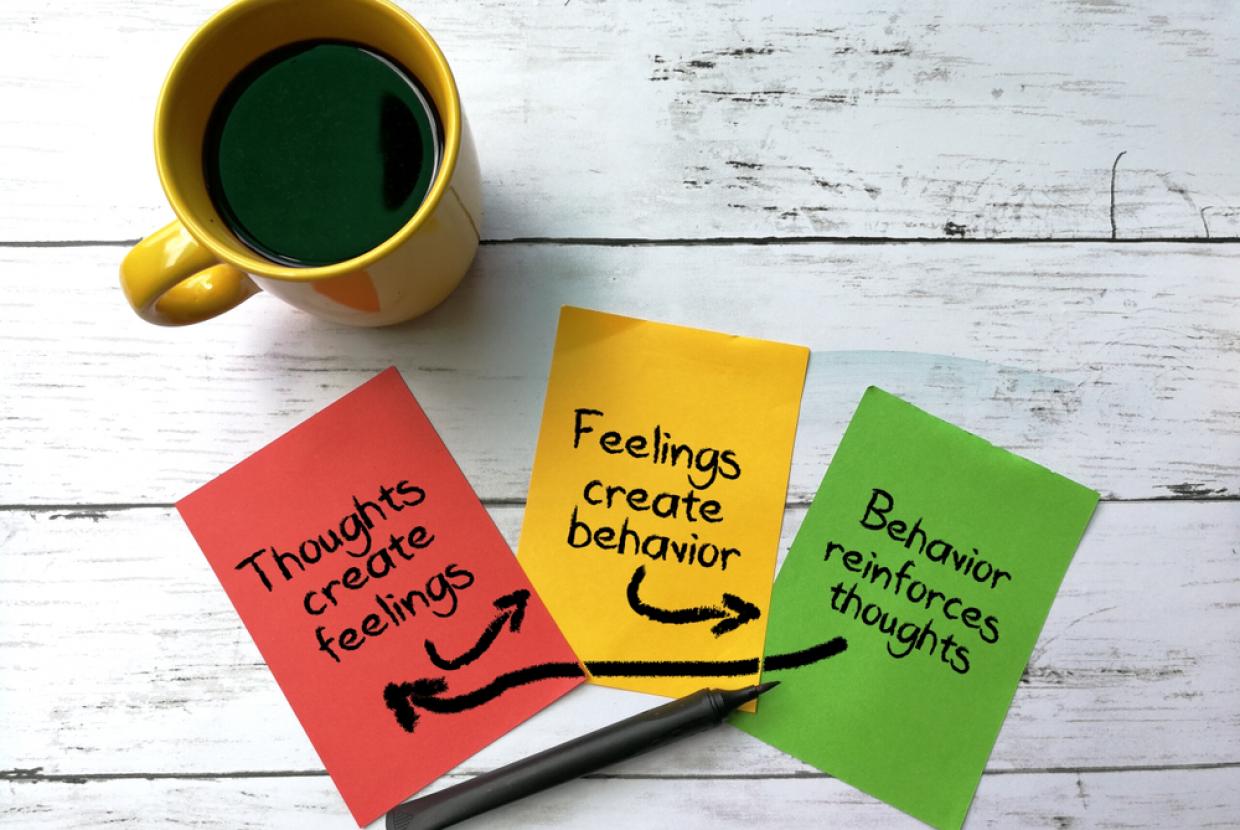

Mental HealthMental health and money are connected. Mental health problems can make earning and managing your money harder, and debt can trigger or worsen conditions such as anxiety, depression and stress.

Why and how do people get into debt?

There is a common misunderstanding that people find themselves in debt due to living an excessive lifestyle or going ‘wild in the aisles’ with credit cards. The truth is that unemployment and redundancy are the most common triggers for debt problems and can happen to anyone, no matter what their attitude to money may be.

Life changes such as losing your job, mental or physical health problems or separating from your partner can mean that you struggle to pay your household bills. Having to adjust to such a financial change can be difficult.

How can mental health problems affect your finances?

There are many reasons why mental ill-health can make it hard to manage your money. If you’re depressed, you might not have the energy or motivation to keep track of your money. If you’re going through a manic episode, you may make rash or unwise decisions with your spending. If you need time off work or a hospital stay, you may be faced with a sudden reduction in income and difficulty keeping up with your bills.

Some mental health problems (and conditions such as dementia) may make it difficult or impossible for you to make decisions about money. The ability to make decisions is known as mental capacity. Someone else may have to make decisions on your behalf if you don't have mental capacity.

How can debt affect your mental health?

A study from the Royal College of Psychiatrists around Debt and mental health found that half of all adults with a debt problem also live with mental ill-health. This ranged from a consistent feeling of anxiety and low mood to a diagnosed mental health condition.

Debt can make you feel anxious, especially if you don’t have support from friends or family or from your creditors. Debt can be a considerable burden, made worse by dealing with it alone.

Worrying about debt can affect your sleep. Losing out on a good night’s sleep can not only affect your mood and energy levels, it can also affect your ability to work or have good relationships with friends and family. All of these things can further add to your debt problem. Questions to ask yourself if you think you may have a debt problem:

- Do I often feel anxious when thinking about how I will manage my repayments?

- Am I struggling to make, or do I routinely miss the minimum payments towards utility bills, credit cards or rent?

- Do I ignore letters from creditors?

- Do I avoid calls from unknown numbers if it’s a creditor calling?

- Am I unable to set aside money for an unplanned financial emergency such as redundancy, car expenses or emergency repairs?

If you answered ‘yes’ to any of these questions, then you may want to consider getting help.

How do I get help?

If you’re dealing with problem debt, you’re not alone. You don’t have to figure it out by yourself. Speak to a debt advisor for free from an organisation such as StepChange, National Debtline or Citizens Advice. They won’t judge you and can help you find ways to manage your debts that you might not know about.

MoneyHelper can help you find online, telephone or face-to-face support in your area. Getting advice can help you feel less anxious, stressed, and more in control of your life.

Talk to someone you trust too, whether that’s a friend, relative or someone supporting you with your mental health. Talking can help you feel less hopeless and alone, and they can help you make an appointment with a debt advisor if you need them to.

How can I help myself?

Getting help from a debt advisor is often the best way to start dealing with debt, but you can also do some things for yourself.

- Find out if you qualify for breathing space, a scheme that freezes any payment demands from your creditors while you get free advice. There are two types: a standard 60-day breathing space or a mental health crisis breathing space. The mental health scheme doesn’t have a time limit. Speak to a debt advisor or read more about it on the Mental Health and Money Advice website.

- Consider telling your creditors about your mental health. This can be difficult, and you must be sure they will take you seriously. Check their website for debt and mental health policies. If you do decide to speak to them, Mind has tips on what to consider.

- You could get a debt and mental health evidence form completed by your doctor or other healthcare professional. This form can help make sure your creditors consider your mental health. It means they must adjust their collections process and how they communicate with you.