Three Ways To Look After Your Mental Health During The Cost-Of-Living Crisis

Mental Health / Cost of Living HelpThe cost-of-living crisis affects almost everyone and all parts of the UK. The cost of heating our homes, keeping the lights on and running the washing machine has increased a lot. And the cost of food means that every meal has to be budgeted for and planned in a way we have not seen for decades.

And of course, the rest of our lives have not stopped. These latest financial worries are on top of our usual stresses around work, family, friends, and our health...

Worrying about these things every day means it can be hard to find the time to look after yourself - it may feel like you do not have the headspace to take on any more.

But even when there's so much going on, it’s important to find time to protect your well-being and mental health.

Stay in touch with friends and family

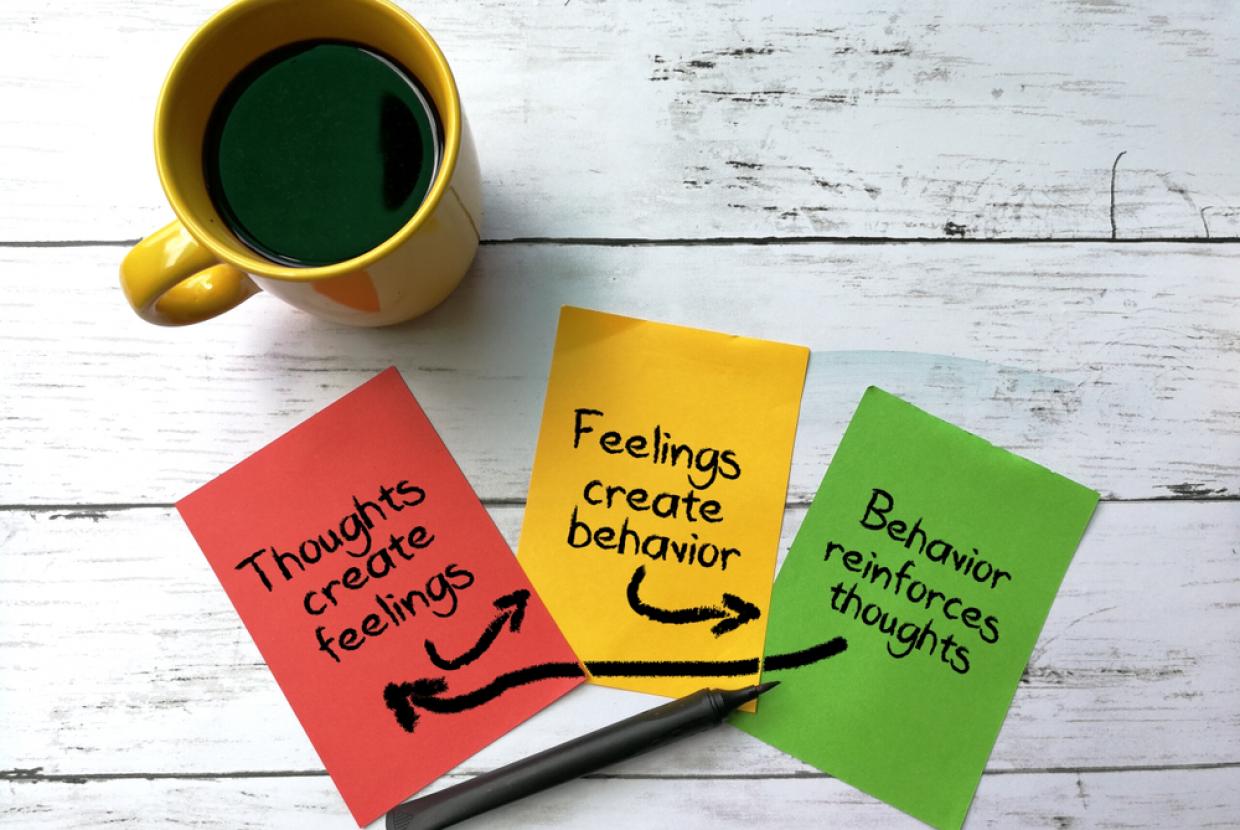

Positive, healthy relationships are always important. In times of trouble these relationships can be even more important. Bottling up worries and letting them go round and round in your head can be damaging. Talking about things with someone you trust can help relieve the pressure, and solutions could even come out of it too. You might also find that they have similar feelings and want to talk about them as well.

It’s normal to worry about how friends and family might react to hearing about your financial issues – but many people are going through something similar and share the same concerns.

If you do not have someone you can easily talk with about your financial worries, you can call a helpline like Samaritans who will listen and help you think and talk through your options.

Get help if you're struggling to manage your finances

It can feel overwhelming when bills keep arriving on your doorstep or in your email inbox, and tempting to ignore them. But try not to do this. Deal with them when they arrive – this way they will not play on your mind or lead to bigger worries like fines and penalties for non-payment.

Most banks, companies and organisations will understand if you get in touch and explain that you’re struggling. If they know your situation, they may help you come up with a manageable payment plan or negotiate another way forward.

Speak to your local Citizens Advice (England, Scotland and Wales) or Advice NI (Northern Ireland) if you’re worried about paying bills and any debts you have. They can also advise you on any benefits you may be entitled to that you’re not getting.

Your local council may also be able to help with emergency loans and grants, and the government’s ‘Help for Households’ has lots of information about what support is available and advice and tips to help you save money.

You can also search online for some free budgeting tools like apps or templates to help you get control of your incomings or outgoings.

Keep doing the things that support good mental health

It’s important to keep looking after your physical health too. In times of stress things like our diet, sleep and getting enough exercise tend to suffer.

But neglecting these areas will have an impact on your mental health, so try to find and stick to good routines:

- Sleep – go to bed and get up at the same time each day, avoid afternoon naps as these can interfere with your sleep patterns and avoid using your phone after you get into bed.

- Diet – it can seem too much effort to cook healthy meals when you’re stressed, but there’s a lot of advice available about cooking on a budget, and most supermarkets offer inspiration and recipe ideas. Junk food can often be expensive, it does not fill you up and can even leave you feeling physically worse than you felt before.

- Exercise – whether it’s going for a walk in the park, a bike ride, a run, or just some stretching at home, using your body every day is important for your well-being.

Content sourced from the Mental Health Foundation (mentalhealth.org.uk).